Fintechzoom Rivian Stock

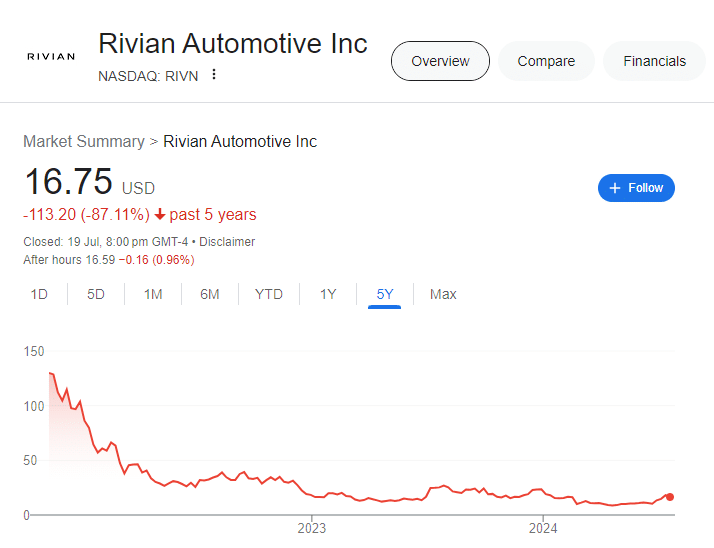

Rivian Automotive made a splashy debut on the public markets in November 2021, raising nearly $12 billion in one of the biggest IPOs of the year. The Amazon-backed electric vehicle startup’s shares opened at $106.75, valuing the company at a massive $86 billion – bigger than Ford and General Motors at the time.

The blockbuster IPO capped a remarkable two-year stretch for Rivian. In 2019, the startup was valued at just $3.2 billion. But thanks to major investments from Amazon, Ford, and others betting on Rivian’s electric pickup and SUV ambitions, the company’s perceived worth skyrocketed leading up to its public listing.

Rivian’s stock price surged out of the gates, hitting an intraday high of $179.47 on November 16th as investor euphoria took hold. At that peak, Rivian boasted a market cap of nearly $153 billion – more valuable than Ford and General Motors combined. The astronomical valuation reflected immense optimism around Rivian’s potential to be a leader in the emerging EV truck market with its R1T pickup and R1S SUV models.

However, Rivian’s shares came back down to earth over the following months amid a broader tech sell-off and supply chain woes hampering the company’s production ramp. After closing out 2021 at $97.86, the stock has continued trending downward in 2022 as competition heats up. As of mid-June, Rivian trades around $30 per share with a market cap of $28 billion – a far cry from its blockbuster IPO but still a hefty valuation for an automaker not yet producing at scale.

FintechZoom Rivian Stock Price Target 2024

FintechZoom, a leading financial research firm, has issued a detailed report on Rivian with an in-depth analysis of the electric vehicle maker’s prospects through 2024. Their analysts have set a bull case price target of $120 per share and a bear case of $40 for Rivian stock by the end of 2024.

The $120 bull case scenario factors in Rivian successfully ramping up production of the R1T pickup and R1S SUV, launching new lower-priced consumer models, and securing significant market share in the electric truck segment. FintechZoom expects Rivian to deliver over 300,000 vehicles in 2024 under this rosy outlook, fueled by strong demand and the execution of its ambitious growth plans.

On the bearish side, the $40 price target reflects risks around continued production delays, higher costs, intensifying competition, and challenges in scaling up a capital-intensive auto business. Supply chain constraints, battery shortages, and economic headwinds could all derail Rivian’s progress, according to FintechZoom’s bear case analysis.

Ultimately, FintechZoom’s base case $75 target price for the end of 2024 implies the stock is currently undervalued, with significant upside if Rivian can hit its milestones. Their thesis centers on Rivian carving out a solid niche in electric trucks and SUVs, leveraging its head start over traditional automakers while taking market share from premium brands like Tesla. However, execution risks loom large for the ambitious startup.

Ramping Up Production and Sales Goals

A key factor in FintechZoom’s bullish 2024 outlook for Rivian stock is the company’s ability to rapidly ramp up production of its R1T pickup truck, R1S SUV, and commercial vans for Amazon. Rivian stumbled out of the gate in 2022 with severe supply chain constraints and internal production issues that limited output to just over 25,000 vehicles.

However, the electric vehicle maker has been working feverishly to iron out its manufacturing challenges at the former Mitsubishi plant in Normal, Illinois. With added shifts and optimization of its processes, Rivian is targeting production of over 300,000 vehicles across its consumer and commercial lines by the end of 2024.

On the consumer side, Rivian hopes to deliver at least 150,000 R1T pickups and R1S SUVs to customers in 2024 to meet the tremendous backlog of over 100,000 pre-orders already on the books. Rivian has also secured an initial order for 100,000 electric delivery vans from Amazon by 2030, with the first 10,000 vans expected to be on the road by late 2024.

Hitting these aggressive production milestones will be crucial for Rivian to achieve economies of scale, lower its costs, and inch towards profitability. Analysts expect Rivian to burn through over $6 billion in cash in 2023 alone, so quickly ramping sales will be essential to stem the cash drain. If Rivian can execute on its 2024 targets, it could put the company on a path towards generating positive operating margins by 2025 or 2026.

Expanding the Rivian Product Lineup

Rivian’s initial product offerings, the R1T electric pickup truck and R1S electric SUV, are squarely aimed at the premium luxury market with price tags starting above $60,000. However, to truly disrupt the automotive industry and capture significant market share, Rivian will need to expand its lineup with more affordable, mainstream models.

According to FintechZoom’s analysis, Rivian is already working on a smaller, more compact electric truck codenamed the R2T that could start around $40,000. This would allow Rivian to compete more directly against electric trucks from legacy automakers like Ford’s affordable F-150 Lightning. An R2S compact electric SUV is likely next on Rivian’s roadmap as well.

Rivian has also teased plans for a high-performance, rally-inspired electric sports car to showcase the performance capabilities of its skateboard EV platform. While this vehicle would be a low-volume halo product, it could help build excitement and brand cachet for Rivian’s more mainstream offerings.

Longer term, Rivian may look to develop a smaller crossover or mid-size SUV riding on a new dedicated EV platform optimized for higher production volumes and lower pricing. An affordable Rivian electric sedan or compact car could eventually round out the lineup to cover all major consumer segments.

Building a full, multi-segment product portfolio is crucial for Rivian to scale up manufacturing, achieve economies of scale, and drive down costs through higher sales volumes. Diversifying beyond just premium trucks and SUVs will also help insulate Rivian from potential economic downturns that could dampen demand for its expensive, luxury-priced models.

Strategic Partnerships and Vertical Integration

Rivian has formed key strategic partnerships that could give the company an edge as it scales production and develops new vehicle models. Most notably, Rivian’s commercial van deal with Amazon involves the e-commerce giant’s equity investment as well as an order for 100,000 electric delivery vans. This provides Rivian with a massive anchor customer and significant revenue stream as it ramps up manufacturing.

The company has also struck deals with Samsung and others to help secure a steady supply of battery cells amid industry-wide shortages. Rivian aims to eventually bring battery pack production in-house through its partnership with Samsung SDI. Similarly, Rivian is working to co-develop cutting-edge drive units, electronics, and semiconductor solutions through partnerships with industry leaders like Samsung and NVIDIA.

This vertically integrated approach, while capital intensive upfront, could pay off big for Rivian down the road. Controlling its own supply chain from batteries to chips will allow for greater cost efficiencies once at scale. It also reduces Rivian’s risk exposure to supply crunches and pricing hikes from third-party suppliers. Overall, Rivian’s strategic partnerships and vertical integration efforts are pillars of its long-term growth strategy to produce affordable EVs with leading-edge technology.

Competitive Landscape in Electric Trucks and SUVs

While Rivian has established an early mover advantage in the electric truck and SUV segments, the competitive landscape is rapidly intensifying. Tesla’s highly anticipated Cybertruck is slated for production in 2024, promising eye-catching avant-garde styling and robust performance from Elon Musk’s EV powerhouse. With Tesla’s brand cachet and manufacturing prowess, the Cybertruck could pose a formidable challenge to Rivian’s R1T pickup.

Traditional automakers are also charging into the electric truck arena. Ford is electrifying its legendary F-150 line, leveraging its decades of full-size truck dominance and massive brand loyalty. GM is countering with an all-electric Silverado, aiming to blend its truck expertise with cutting-edge EV technology. These legacy brands boast extensive manufacturing capabilities, deep supplier relationships, and vast dealer networks – advantages that could help them quickly scale electric truck production.

On the startup front, companies like Lordstown Motors, Canoo, and Bollinger are all vying to stake a claim in the nascent electric truck market with innovative designs. While these newcomers lack Rivian’s head start and funding, their fresh thinking and clean-sheet approaches could appeal to buyers seeking alternatives to conventional truck styling.

Rivian’s key advantages lie in its exclusive focus on EVs from the outset, positioning it as a true “electric brand” rather than legacy automakers adapting existing platforms. Its unique design language, extensive testing, and vertical integration with battery production and charging networks are also differentiators. However, Rivian faces the challenges of scaling up as a startup while rivals like Tesla, Ford, and GM can leverage their extensive manufacturing footprints and supplier ecosystems.

Ultimately, the electric truck battle will likely come down to product execution, pricing strategy, and each brand’s ability to build an engaging consumer experience around their EVs. With multiple players entering the fray, competition will only intensify – putting pressure on Rivian to rapidly increase production, enhance its offerings, and double down on creating a passionate customer base.

Projections for the Overall EV Market

The global electric vehicle (EV) market is projected to see explosive growth over the next decade as more consumers and governments embrace sustainable transportation. According to FintechZoom’s analysis, annual EV sales could surpass 30 million units by 2030, representing over 30% of total new vehicle sales worldwide. This would mark a seismic shift from just a few years ago when EVs accounted for less than 5% of the market.

Several key trends are driving this monumental growth in EV adoption. Continual advancements in battery technology leading to longer ranges and lower costs have helped alleviate consumer range anxiety. At the same time, a proliferation of new EV models across all vehicle segments from sedans to pickup trucks provides options to meet any driving need. Stricter emissions regulations in Europe, China, and other major markets are also forcing automakers to rapidly electrify their lineups.

Within this booming EV landscape, FintechZoom sees Rivian capturing a lucrative piece of the pie. The firm projects Rivian could sell over 500,000 vehicles annually by 2027, translating to around 2-3% global EV market share. While a small percentage, this would position Rivian as a leader in the premium electric truck and SUV categories that the company is laser-focused on. Rivian’s unique skateboard platform designed for larger vehicles gives it an early mover advantage over established rivals still investing heavily into EV architectures.

Major Risks Facing Rivian’s Growth Story

While Rivian has grand ambitions and FintechZoom’s analysis paints an optimistic picture, the electric vehicle startup faces significant risks that could derail its growth trajectory and weigh heavily on the stock price.

Supply chain constraints and chip shortages remain an ongoing challenge for Rivian and the entire auto industry. Securing a steady supply of batteries, semiconductors, and other critical components will be crucial for Rivian to ramp up production without further delays. Any disruptions could throttle output and miss delivery targets.

Competition in the electric truck and SUV segments is rapidly intensifying as legacy automakers like Ford, GM, and startups like Rivian enter the fray. Rivian’s first-mover advantage could quickly erode if competitors bring superior or more affordable models to market faster. Brand loyalty will be tested as consumers weigh their options.

An economic downturn or recession would likely dampen demand for Rivian’s premium, high-priced vehicles aimed at affluent buyers. During periods of financial stress, consumers may prioritize needs over wants and delay big-ticket purchases like the $67,500 R1T truck. Inflation and rising interest rates pose additional headwinds.

Execution risks abound as an unproven manufacturer scales operations at a breakneck pace. Quality control issues, battery fires, or other snafus could tarnish Rivian’s brand reputation from the start. The company must flawlessly deliver on its promises to early customers and investors.

Bottom Line: Should You Buy Rivian Stock?

Weighing the pros and cons, Rivian undoubtedly faces immense challenges and risks as it ramps up an entirely new automotive business in the fiercely competitive EV market. However, FintechZoom’s analysis suggests the potential rewards could be tremendous for investors willing to embrace Rivian’s ambitious vision and unique position as a first-mover in electric trucks.

On the positive side, Rivian’s strong $17 billion cash reserves from going public and strategic partnerships give it a solid runway to increase production capacity and bring new models to market. If the company can execute on its plans and capture even a slice of mainstream truck buyers, the upside could be massive given Rivian’s head start over forthcoming electric truck competition.

Additionally, Rivian’s vertical integration strategy for key components like batteries and chips could prove advantageous in an environment of supply chain constraints. Controlling its own production lines reduces reliance on third-party suppliers that have hamstrung other automakers.

That said, Rivian remains a speculative investment at this stage. Production delays, higher costs, battery sourcing issues, or a potential recession denting demand for premium trucks and SUVs could all derail the company’s ambitious trajectory. Incumbent automakers like Ford and GM also can’t be counted out as they transition more aggressively into EVs.

Ultimately, FintechZoom believes the risk/reward profile is enticing enough to rate Rivian stock as a Buy for 2024, albeit with an “Aggressive” risk rating. The firm’s $115 price target implies significant upside from current levels around $30. But investors should have a high risk tolerance and lengthy time horizon, as it may take several years for Rivian’s growth story to fully play out.

For patient investors able to withstand volatility, taking an initial position in this emerging EV disruptor could pay off handsomely down the road. But more risk-averse investors may want to watch from the sidelines until Rivian establishes itself as a consistent profit generator with a proven track record of execution.