Fintechzoom AMC Stock

AMC Entertainment Holdings, Inc., one of the largest movie theatre chains in the world, has become a focal point for both retail and institutional investors. This interest peaked especially during the COVID-19 pandemic when the company faced significant financial challenges but garnered substantial attention from retail investors, leading to dramatic price movements. On Fintechzoom AMC stock is analyzed for its intriguing performance and the factors influencing its trajectory.

AMC Stock Performance Analysis

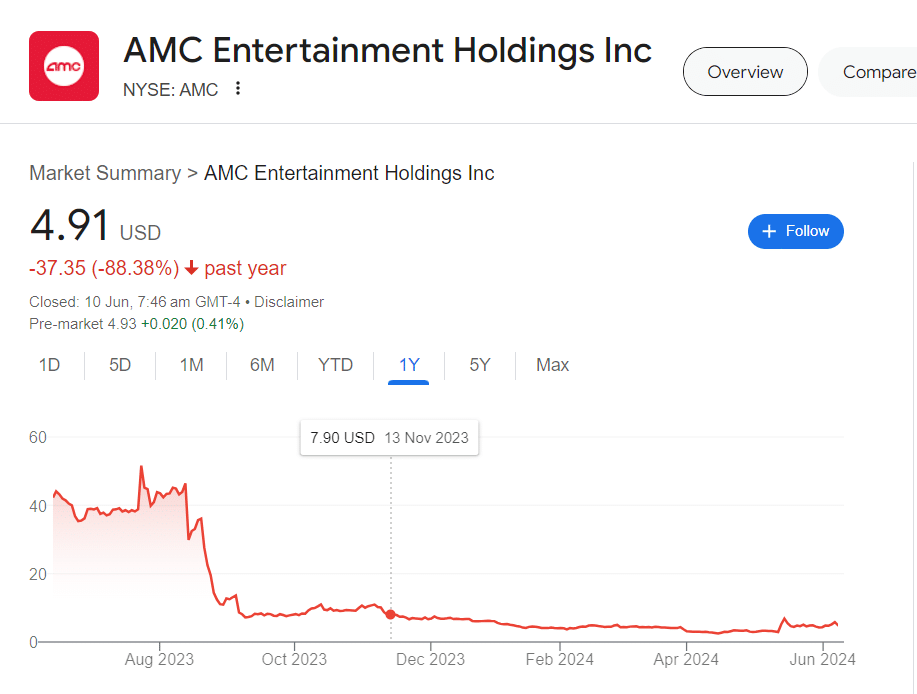

Historical Performance

AMC Entertainment’s stock has seen a turbulent history. Originally trading at modest levels, AMC’s stock experienced a dramatic rise in early 2021, fueled by a coordinated effort from retail investors on forums like Reddit’s WallStreetBets. This surge was part of a broader trend of “meme stocks,” where retail investors drove up prices of heavily shorted stocks, causing a short squeeze.

Recent Trends and Movements

In recent months, AMC’s stock price has fluctuated significantly. Key events, such as quarterly earnings reports, changes in theater attendance, and broader market trends, have all contributed to its volatility. The stock has also seen movements based on news of potential new business ventures and the overall recovery of the entertainment industry post-pandemic.

Key Factors Influencing AMC Stock

Several factors influence AMC’s stock price:

- Market Sentiment: The enthusiasm of retail investors continues to be a major driver.

- Financial Health: AMC’s ability to manage its debt and generate revenue.

- Industry Trends: The broader health of the entertainment industry, including movie theater attendance rates.

- Macro-Economic Conditions: Economic recovery post-pandemic and consumer spending patterns.

Financial Metrics and Valuation

Analyzing AMC’s financial metrics provides insight into its valuation:

- Revenue: AMC’s revenue streams primarily from box office sales and concessions, with fluctuations based on movie releases and attendance.

- Debt Levels: The company has significant debt, impacting its long-term sustainability and stock valuation.

- Earnings Per Share (EPS): EPS has been volatile, reflecting the company’s struggle to return to profitability amidst fluctuating revenues and high debt servicing costs.

Expert Opinions and Predictions

Market analysts are divided on AMC’s future. Some believe that the stock is overvalued given its financial challenges, while others see potential in its recovery and the continued support from retail investors. Expert predictions range from cautionary stances to optimistic outlooks based on potential new revenue streams and strategic shifts.

Comparing AMC with Competitors

Cinemark Holdings, Inc. (CNK)

Cinemark, another major theater chain, has shown a more stable financial performance compared to AMC. While it also faced challenges during the pandemic, its stock has not experienced the same level of volatility.

Regal Entertainment Group

Regal, part of Cineworld Group, has similarly struggled but has managed its debt more effectively. The comparative stability in its stock price reflects a more traditional recovery path without the meme stock influence.

Investment Strategies for AMC Stock

Investors considering AMC stock should:

- Short-term Trading: Capitalize on volatility by trading around key events and market sentiment.

- Long-term Holding: Believe in the potential recovery of the entertainment industry and AMC’s ability to innovate and manage its debt.

- Diversified Portfolio: Balance investments in AMC with more stable stocks to mitigate risks.

Benefits and Risks in AMC Stock

Benefits

- High Volatility: Potential for significant short-term gains.

- Strong Retail Support: Continued interest from retail investors can drive up the price.

- Recovery Potential: The entertainment industry’s recovery could boost revenues.

Risks

- Financial Instability: High debt levels pose a significant risk to long-term sustainability.

- Market Volatility: Price swings can result in substantial losses.

- Competitive Pressure: Increased competition from streaming services and other theaters.

Conclusion

AMC stock represents a unique investment opportunity characterized by high volatility and significant risks and rewards. While it has shown resilience and potential for recovery, investors must be cautious and consider the broader market and industry trends.

Key Takeaways

- AMC stock has experienced dramatic fluctuations driven by retail investor interest.

- Key factors influencing its stock price include market sentiment, financial health, and industry trends.

- Comparing AMC to competitors like Cinemark and Regal shows differing recovery paths and financial stability.

- Investment strategies should consider short-term trading, long-term holding, and portfolio diversification.

- Benefits include high volatility and recovery potential, while risks encompass financial instability and competitive pressure.