Fintechzoom Meta Stock

Meta, formerly known as Facebook, has shown substantial growth since its IPO in 2012. Its stock has seen significant appreciation, driven by the company’s dominant position in social media and digital advertising. Key milestones include the acquisition of Instagram in 2012, WhatsApp in 2014, and the rebranding to Meta in 2021 to emphasize its focus on the metaverse.

Fintechzoom Meta Stock

FintechZoom’s analysis of Meta (formerly Facebook) stock is generally optimistic. Analysts have a “moderate buy” rating with price targets ranging from $280 to $610. The company shows potential in its investments in virtual reality and the metaverse, but faces significant competition and regulatory challenges. Investors are advised to consider technical analysis and event-driven strategies, and possibly wait for the stock price to dip before buying.

Key Take Aways

- Meta has a strong historical growth trajectory but faces recent volatility.

- Regulatory scrutiny and market competition are key challenges for Meta.

- Meta’s investment in VR, AR, and the metaverse is a significant growth driver.

- Financial metrics show solid revenue growth but also highlight dependency on advertising.

- Investment strategies should consider both short-term volatility and long-term potential.

Recent Trends and Movements

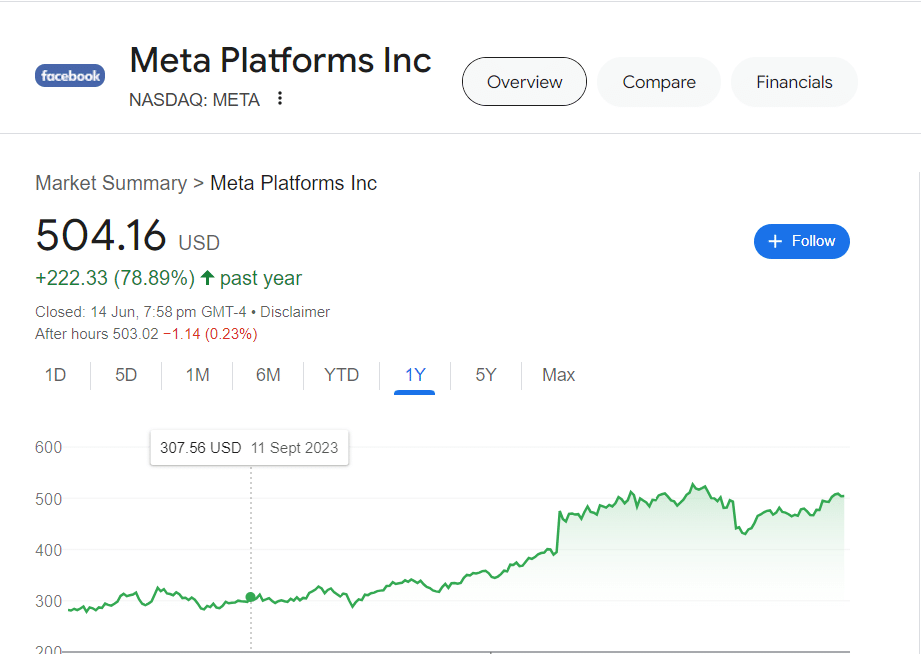

Recently, Meta’s stock has experienced fluctuations influenced by market conditions, regulatory scrutiny, and changes in user engagement. The company’s investment in virtual reality and the metaverse has sparked both excitement and skepticism among investors, affecting short-term stock performance.

Key Factors Influencing Meta Stock

- Regulatory Environment: Ongoing scrutiny and potential regulations around data privacy and antitrust issues.

- Technological Innovations: Developments in VR/AR and metaverse initiatives.

- User Growth and Engagement: Fluctuations in daily active users (DAUs) and overall engagement metrics.

- Advertising Revenue: Dependence on advertising revenue and changes in digital ad spending trends.

Financial Metrics and Valuation

Meta’s valuation is primarily driven by its revenue growth, profit margins, and cash flow. Key financial metrics include:

- Price-to-Earnings (P/E) Ratio: A measure of current share price relative to earnings per share.

- Revenue Growth Rate: Annual growth rate of Meta’s revenue from advertising and other sources.

- Net Income and Profit Margins: Indicators of profitability and operational efficiency.

Expert Opinions and Predictions

Analysts have mixed opinions on Meta’s future. Some are bullish, citing the company’s innovation and leadership in the tech space, while others are cautious due to regulatory risks and market competition. Predictions range from continued growth in stock value to potential volatility based on external factors.

Comparing Meta with Competitors

Alphabet (Google)

Alphabet, Meta’s primary competitor in digital advertising, has a diversified revenue stream, including cloud computing and hardware. Both companies compete fiercely in the ad space, but Alphabet’s broader diversification might offer more stability.

Apple

Apple’s recent privacy changes have significantly impacted Meta’s advertising model. As a competitor, Apple focuses more on hardware and software ecosystems, yet its influence on digital advertising and app policies directly affects Meta.

Microsoft

Microsoft competes with Meta in areas like digital advertising and virtual reality (via HoloLens). However, Microsoft’s focus on enterprise solutions and cloud services provides a different revenue model, making it a diversified competitor.

Investment Strategies for Meta Stock

Investors considering Meta should evaluate their risk tolerance and investment horizon. Strategies might include:

- Long-term Holding: Belief in Meta’s future growth in the metaverse and VR/AR space.

- Short-term Trading: Taking advantage of stock volatility based on quarterly earnings and news.

- Diversification: Balancing investment in Meta with other tech and non-tech stocks to mitigate risk.

Also Read: Lucid Stock: An In-Depth Analysis

Benefits and Risks in Meta Stock

Benefits

- Market Leadership: Dominance in social media and digital advertising.

- Innovation: Strong focus on future technologies like VR, AR, and the metaverse.

- Revenue Growth: Consistent revenue and profit growth driven by advertising.

Risks

- Regulatory Threats: Potential for increased regulation in data privacy and antitrust.

- Market Competition: Intense competition from other tech giants like Alphabet, Apple, and Microsoft.

- Dependence on Advertising: Heavy reliance on advertising revenue which can be affected by market changes.

Conclusion

Meta’s stock presents a mix of opportunities and challenges. While the company’s innovation and market position are strong, regulatory risks and competition are significant factors to consider. Investors should weigh these elements carefully when considering Meta for their portfolio.

FAQs

How does FintechZoom help with Meta stock analysis?

FintechZoom offers detailed analysis, real-time updates, and financial reports that help investors understand Meta’s stock performance.

Why is Meta stock a good investment?

Meta stock is considered a good investment due to its strong market position, innovative products, and robust financial performance.

What are the risks of investing in Meta stock?

Risks include regulatory challenges, market saturation, and increasing competition, which could affect Meta’s growth.

How can I start investing in Meta stock?

To start investing in Meta stock, open a brokerage account, research the stock, decide on the number of shares, and place an order through your broker.