FintechZoom BA Stock Updated Price, Benefits and Risks

FintechZoom BA stock insights provide crucial information for investors eyeing the aerospace and defense sector. Boeing (BA) stock, as a major player in aviation, garners significant attention. This article offers a detailed overview of FintechZoom BA stock, including its history, current price, investment benefits and risks, future predictions, and a step-by-step investment guide.

What Is FintechZoom BA Stock?

FintechZoom BA stock refers to the financial insights and analysis available on FintechZoom for The Boeing Company. Boeing, a leading global aerospace manufacturer, designs and manufactures commercial jetliners, defense, space, and security systems. As a market leader, Boeing’s stock is a popular choice for investors seeking exposure to the aerospace sector.

History of FintechZoom BA Stock

Founded in 1916, Boeing went public in 1962. Over the decades, Boeing has expanded through innovations and strategic acquisitions, establishing itself as a cornerstone of the aerospace industry. FintechZoom BA stock analysis tracks these historical milestones and significant stock fluctuations influenced by technological advancements, geopolitical events, and economic cycles.

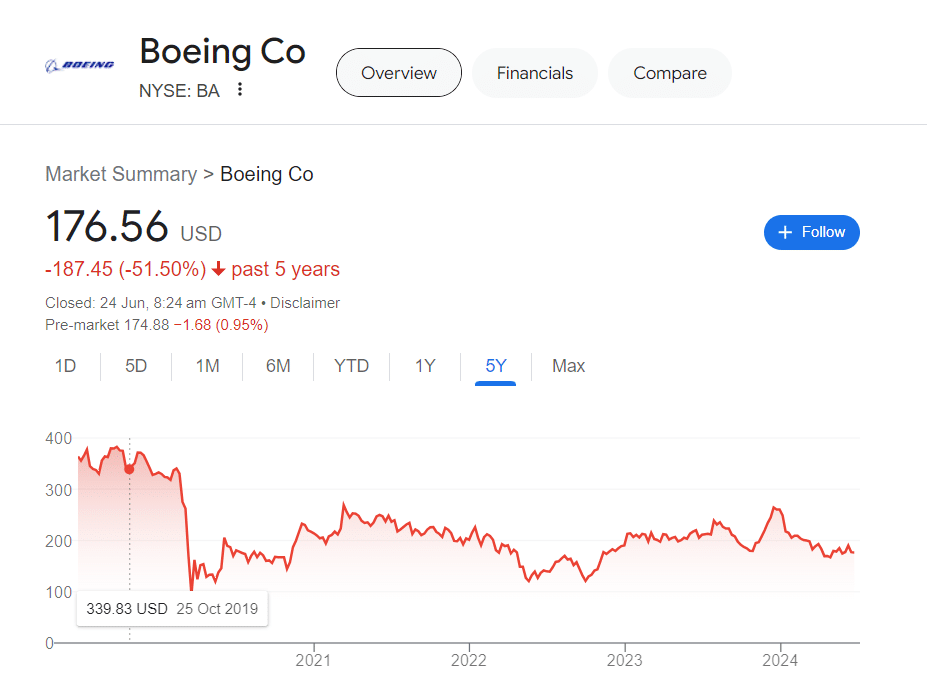

FintechZoom BA Stock Updated Price 2024

As of 2024, FintechZoom BA stock is priced at $176.56. The stock’s performance is shaped by various factors, including market trends, company earnings reports, and broader economic conditions. For real-time stock prices, investors should refer to FintechZoom or other reliable financial news sources.

Benefits of FintechZoom BA Stock Investment

- Industry Leadership: Boeing is a market leader in aerospace manufacturing with a robust portfolio.

- Global Presence: Boeing’s international footprint provides diverse revenue streams.

- Innovation and R&D: Continuous investment in research and development keeps Boeing at the forefront of technological advancements.

- Government Contracts: Substantial contracts from the U.S. government provide steady revenue.

Risks of FintechZoom BA Stock Investment

- Economic Cycles: Aerospace demand is cyclical, closely tied to economic health, affecting Boeing’s sales and stock price.

- Regulatory Challenges: Boeing faces stringent regulatory scrutiny impacting operations and profitability.

- Supply Chain Issues: Disruptions can delay production and increase costs.

- Geopolitical Risks: International tensions and trade policies can affect Boeing’s global operations and sales.

Future Prediction of FintechZoom BA Stock

Analysts provide mixed predictions for FintechZoom BA stock, considering the recovery of the aviation industry post-pandemic, ongoing innovations, and potential new contracts. Some foresee robust growth driven by increased air travel demand and defense spending, while others caution about economic uncertainties and competition.

Step by Step Investment Guidelines for FintechZoom BA Stock

- Research: Thoroughly research Boeing’s financial health, market position, and industry trends on FintechZoom.

- Set Goals: Define your investment goals and risk tolerance.

- Choose a Broker: Select a reliable stockbroker offering FintechZoom BA stock.

- Monitor Market: Keep an eye on market trends and news affecting Boeing through FintechZoom.

- Buy Stock: Purchase FintechZoom BA stock through your chosen broker.

- Review Portfolio: Regularly review and adjust your investment portfolio based on performance and market conditions.

Also Read: Updates about Meta Stock

Conclusion

Investing in FintechZoom BA stock offers potential rewards due to Boeing’s industry leadership and global presence. However, investors should consider associated risks and stay informed about market trends. With diligent research and strategic planning, FintechZoom BA stock can be a valuable addition to an investment portfolio.