Fintechzoom Amazon Stock

Amazon has emerged as one of the world’s most dominant companies, with a seemingly unstoppable presence across diverse sectors like e-commerce, cloud computing, digital advertising, and more. Its journey from an online bookstore to a globally renowned tech titan has been remarkable.

In the e-commerce realm, Amazon maintains an iron grip, accounting for nearly 40% of all online retail sales in the U.S. Its Prime membership program, with over 200 million subscribers, fosters exceptional customer loyalty and repeat purchases. The company’s logistics capabilities, with fleets of planes, trucks, and a rapidly expanding warehouse network, give it an unparalleled competitive edge.

Amazon Web Services (AWS), the company’s cloud computing division, is another crown jewel. AWS holds a staggering 34% share of the global cloud infrastructure market, making it the undisputed leader. From startups to large enterprises, businesses worldwide rely on AWS for storage, computing power, databases, and a suite of cloud-based services.

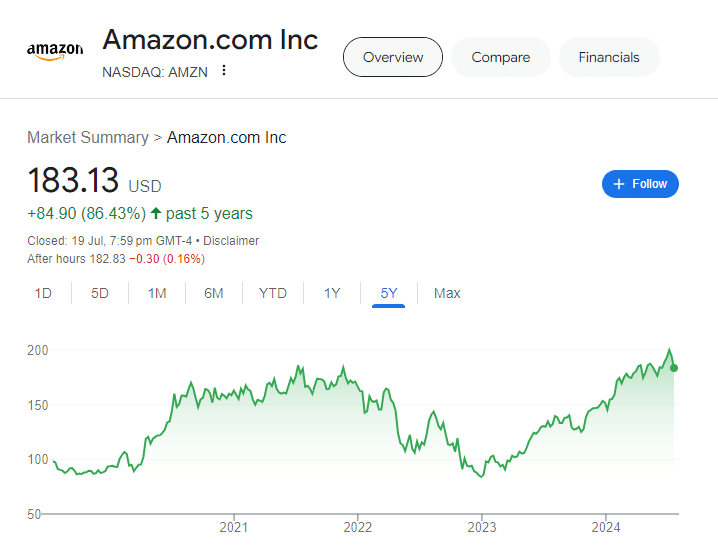

Amazon’s stock (AMZN) has been a star performer, rising over 400% in the last decade despite recent volatility. The company currently commands a market capitalization of around $1.2 trillion, cementing its position among the world’s most valuable public companies. While Amazon trades at a premium valuation, with a trailing P/E ratio of around 130, investors continue to bet on its long-term growth prospects.

FintechZoom Amazon Stock Price Targets

Amazon’s stock has been a star performer over the past decade, with the e-commerce and cloud computing giant emerging as one of the world’s most valuable public companies. Many analysts at FintechZoom are extremely bullish on Amazon’s prospects, setting bold price targets well above the $3,000 level that the stock currently trades at.

Several FintechZoom analysts have 12-month price forecasts on Amazon in the $4,000 to $5,000+ range, suggesting potential upside of 30% to 60% from current levels. The most optimistic analysts see Amazon climbing to $6,000 per share in the next few years if the company can continue executing on its growth strategy.

The primary driver behind the bullish thesis is the expectation for robust growth in Amazon’s high-margin cloud computing division, Amazon Web Services (AWS). As businesses accelerate their shift to the cloud, AWS stands to grow its already-dominant market share. AWS revenue grew by 37% in 2022 and now accounts for over 16% of Amazon’s total revenue.

Analysts also point to Amazon’s opportunities in relatively new business lines like digital advertising and healthcare as potential growth engines. Amazon is leveraging its strong consumer brand and datasets to grab market share in the lucrative ad tech space. Its acquisition of primary care provider One Medical provides a foothold in the healthcare sector.

While Amazon’s core e-commerce operations face rising competition, the company continues to pour billions into expanding logistics and fulfillment capabilities. This should allow Amazon to maintain its edge and grow prime subscription revenues steadily. Overall, FintechZoom’s experts believe Amazon’s strong fundamentals and ability to diversify into new verticals will propel the stock higher in the years ahead.

Amazon’s Key Revenue Growth Drivers

Amazon’s future growth is expected to be fueled by several key revenue drivers across its diversified business segments. The company’s high-margin AWS cloud computing division remains a powerhouse, benefiting from enterprises’ accelerating digital transformation and cloud migration efforts. With its comprehensive suite of services and robust data center infrastructure, AWS is firmly entrenched as the market leader and is poised to maintain its dominance.

Another promising growth avenue is Amazon’s rapidly expanding digital advertising business. As the e-commerce behemoth garners valuable consumer data and deepens its marketing and advertising capabilities, it is emerging as a formidable challenger to Google and Facebook in the online ad space. Amazon’s unique ability to integrate advertising across its retail platforms presents significant revenue upside.

The company is also making strategic forays into the healthcare industry, which could unlock new revenue streams. Amazon’s initiatives include telemedicine services, pharmaceutical distribution, and potentially disrupting the healthcare supply chain with its logistics expertise. While still in its early stages, Amazon’s healthcare ambitions could reshape the sector and drive long-term value.

Moreover, Amazon’s core e-commerce business continues to solidify its market dominance. With massive investments in logistics, fulfillment centers, and Prime membership benefits, the company has created significant barriers to entry and economies of scale that solidify its leadership position. As consumer spending shifts online, Amazon is well-positioned to capture a growing share of the retail market, both in the US and internationally.

Risk Factors and Bear Case for Amazon Stock

Amazon’s meteoric rise and market dominance have drawn increasing regulatory scrutiny over potential antitrust issues. Lawmakers and government agencies are concerned about Amazon’s power across multiple sectors like e-commerce, cloud computing, digital advertising, and smart home devices. There are ongoing investigations into whether Amazon has engaged in anti-competitive practices that stifle rivals. Any adverse rulings could potentially force Amazon to divest assets or restructure parts of its business, impacting growth and profitability.

While Amazon’s high-margin AWS cloud business has been a key profit driver, the core e-commerce segment faces intense competition and margin pressures. Rivals like Walmart have doubled down on online retail, undercutting Amazon on pricing for certain product categories. The costs of shipping, logistics, and technology investments remain high for Amazon’s retail operations. There are concerns that as Amazon’s online store grows, it will be difficult to sustain the robust profit margins it has enjoyed historically.

Amazon’s aggressive diversification into areas like digital advertising, entertainment, and healthcare provides new growth runways but also spreads resources thin. Maintaining a competitive edge across all these new verticals could prove challenging. Missteps in execution or overextending could lead to a growth slowdown if Amazon fails to gain traction in these emerging businesses. Overall, the bear case rests on Amazon being too dominant and facing breakup risks, while also struggling with rising costs and new competitive threats.

Valuing Amazon Stock vs Peers

Amazon trades at a premium valuation compared to mega-cap tech peers like Microsoft, Apple, and Alphabet (Google’s parent company). As of July 2023, Amazon’s trailing price-to-earnings (P/E) ratio stands at around 120x, significantly higher than Microsoft at 35x, Apple at 30x, and Alphabet at 28x.

The elevated P/E reflects Amazon’s strong earnings growth expectations as it continues to invest heavily in expanding its e-commerce operations, cloud computing with AWS, digital advertising, and other high-growth verticals. Amazon’s price-to-sales (P/S) ratio of 2.8x also tops Microsoft at 11x, Apple at 7x, and Alphabet at 5.5x.

While Amazon appears richly valued based on traditional metrics, investors are paying up for its leadership across multiple disrupted markets and ability to compound high revenue growth over many years. AWS alone is expected to drive over $100 billion in annual revenues for Amazon by 2025.

As the e-commerce and cloud computing markets continue rapidly expanding, Amazon is well-positioned to maintain its dominance and grow into its premium valuation over time. However, the stock is not cheap, and investors will need to depend on Amazon delivering on very optimistic future growth plans to justify the current heady multiples.

FintechZoom Amazon Stock Price Forecast 2025

After weighing the bullish and bearish factors, FintechZoom analysts have an overall positive outlook on Amazon’s stock. The e-commerce giant’s continued dominance in cloud computing via AWS, coupled with promising growth in areas like digital advertising and healthcare, position the company for sustained revenue and earnings expansion over the next several years.

While regulatory risks and heightened competition can’t be ignored, Amazon’s ability to diversify revenue streams and enter new verticals provides multiple growth levers. The company’s strong balance sheet and consistent free cash flow generation also instill confidence.

FintechZoom is forecasting Amazon’s stock price to reach $5,500 by 2025, representing a potential upside of over 40% from current levels around $3,900. This bullish price target is underpinned by projected annual revenue growth of 15-20% and earnings per share growth north of 25% annually through 2025.

With Amazon trading at a still reasonable 25x forward earnings multiple, there is a compelling opportunity for long-term investors to buy this FANG leader at a relatively attractive valuation entry point. FintechZoom recommends accumulating shares of Amazon on any near-term dips and holding for a $5,500+ price over the next 3-4 years.

Should You Buy, Hold or Sell Amazon Stock?

After a thorough analysis of Amazon’s fundamentals, growth prospects, competitive positioning, and valuation, FintechZoom analysts have a positive outlook on the stock. While risks like regulatory scrutiny and margin pressures remain, Amazon’s dominance in cloud computing, advertising, and e-commerce provide multiple durable growth engines.

The firm’s price target of $5,200 per share represents a potential upside of over 35% from current levels. FintechZoom recommends investors buy Amazon stock and hold for the long-term, as the e-commerce giant continues disrupting multiple industries and generating robust cash flows.

Amazon’s ability to consistently invest in innovation while maintaining leadership across its core verticals is a key strength. The company’s customer-obsessed culture and willingness to forgo short-term profits for long-term market share gains bode well for future growth. FintechZoom has a high conviction buy rating on AMZN.

Conclusion

Amazon has cemented its status as a global technology and e-commerce powerhouse, dominating multiple industries and delivering exceptional returns for investors. The company’s relentless focus on innovation, customer obsession, and long-term strategy has enabled it to maintain its market leadership and capture new growth avenues, from cloud computing and digital advertising to healthcare.

While Amazon trades at a premium valuation, analysts at FintechZoom remain bullish on the stock, citing the company’s durable competitive advantages and multiple paths for continued revenue and earnings growth. With a 2025 price target of $5,500 per share, FintechZoom believes Amazon presents a compelling long-term investment opportunity for investors willing to hold through periods of volatility.

As Amazon navigates evolving risks, including regulatory scrutiny and rising competition, the company’s track record of innovation and execution suggests it is well-positioned to sustain its dominance and deliver outsized returns for shareholders in the years ahead.