Fintechzoom Uber Stock – Fintechzoom Strategies for Investing in Uber Stock

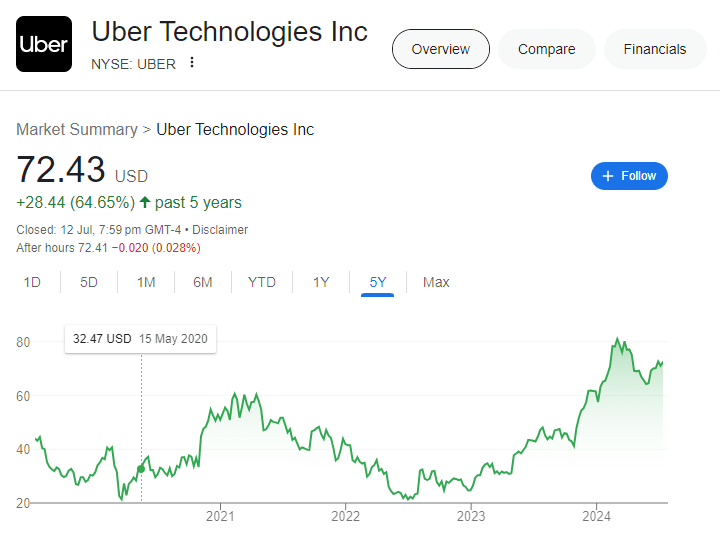

In 2024, Uber Technologies Inc. (NYSE: UBER) continues to be a major player in the ridesharing and food delivery markets. As of mid-2024, Uber’s stock price hovers around $45 per share, with a 52-week range of $38 to $53.

Over the past year, Uber’s stock has experienced modest gains of around 8%, outperforming the broader market indexes. The company’s Q1 2024 earnings report showed strong revenue growth of 27% year-over-year, reaching $8.6 billion. However, profitability remains an issue, with Uber posting a net loss of $594 million for the quarter.

Key financial metrics from Uber’s latest earnings:

- Revenue: $8.6 billion (+27% YoY)

- Net Loss: $594 million

- Gross Bookings: $31.4 billion (+19% YoY)

- Monthly Active Platform Consumers: 134 million (+15% YoY)

While Uber’s core rideshare business is rebounding from pandemic lows, the Uber Eats delivery segment is driving much of the company’s top-line growth. Investors are closely watching Uber’s ability to improve profitability and cash flow as the business scales.

Key Factors Impacting Fintechzoom Uber Stock in 2024

In 2024, Uber’s stock performance is being shaped by a mix of headwinds and tailwinds across its core businesses. One major challenge has been the sustained high cost of fuel, which directly impacts the company’s rideshare operations and profitability. Despite efforts to offset these costs through temporary fuel surcharges, rising fuel expenses have put downward pressure on Uber’s earnings.

However, Uber has found growth opportunities in its delivery verticals like Uber Eats. The convenience of food and grocery delivery has resonated strongly with consumers, driving consistent revenue increases for this segment. Uber has doubled down on Eats by expanding partnerships with restaurants and investing in delivery-optimized infrastructure. Its acquisition of Postmates in 2020 further bolstered Uber’s delivery capabilities.

Another high-growth division is Uber Freight, the company’s logistics and trucking arm. As the world’s supply chains strained under pandemic disruptions, Uber Freight’s digital brokerage platform facilitated more efficient shipping. Uber has onboarded thousands of trucking companies, providing much-needed freight capacity. Freight’s success in reducing inefficiencies positions it as a future growth engine.

Within Uber’s core rideshare market, intensifying competition has emerged as both a challenge and an opportunity. While rivals like Lyft remain formidable, Uber’s sheer scale provides advantages. However, the entrance of well-funded autonomous vehicle companies could disrupt the rideshare landscape long-term. Uber has invested in self-driving research, but bringing this technology to market at scale remains an open question that could reshape Uber’s future trajectory.

Bull vs. Bear Cases for Fintechzoom Uber Stock

Bull Case: Growth Opportunities and Market Leadership

Uber’s multi-billion dollar investments in expanding its platform beyond just ridesharing are starting to pay off. Uber Eats has rapidly grown to become a major player in the food delivery market, benefiting from pandemic-driven demand and the network effects of more drivers and restaurants joining the platform. With its global reach and logistics capabilities, Uber is well-positioned to maintain a leadership position in this fast-growing market.

Additionally, Uber’s move into freight trucking and logistics through acquisitions like Transplace is tapping into an enormous total addressable market. Uber Freight’s digital brokerage model and Uber’s expertise in matching supply and demand could disrupt the traditional freight industry. As one of the first tech players in this space, Uber has a head start on building a next-generation freight platform.

Uber’s global scale, brand recognition, and aggressive investments in diversifying its business lines could translate into sustained revenue growth and market share gains. Investors are bullish that Uber can leverage its platform to lead multiple industries beyond just ridesharing.

Bear Case: Persistent Profitability Struggles and Competition

Despite Uber’s revenue growth, the company continues to struggle with profitability as it spends heavily on expansion, legal/regulatory issues, and driver incentives to attract and retain workers. Uber has built up over $9 billion in accumulated deficits, leading some investors to question the economics and sustainability of its business model.

Competition also remains intense across all of Uber’s markets. Ridesharing competitors like Lyft continue to put pricing pressure on Uber, while the food delivery market is crowded with players like DoorDash and GrubHub. In freight, Uber will face challenges breaking into an entrenched industry with incumbents like C.H. Robinson.

There are also lingering regulatory risks around the employment status of gig workers that could significantly impact Uber’s costs. The bear thesis is that even with diversification, Uber will continue struggling to turn a profit due to competitive and regulatory forces working against it. Failure to achieve sustainable profitability could put a cap on Uber’s growth ambitions.

Valuation and Recommendations

To determine a fair valuation for Uber’s stock in 2024, we can analyze metrics like price-to-sales (P/S) and price-to-earnings (P/E) ratios compared to peers in the ridesharing and food delivery markets.

Uber’s current P/S ratio of 2.8x is higher than Lyft’s at 1.9x but lower than DoorDash’s at 4.1x and GrubHub’s at 3.5x. This suggests Uber is being valued at a premium over pure rideshare plays like Lyft, likely due to its diversification into delivery.

However, Uber’s P/E ratio of 65x is quite high compared to Lyft at 11x. While delivery peers trade at lofty valuations too, Uber’s P/E is still well above DoorDash at 45x. This indicates the market is pricing in significant future earnings growth expectations for Uber.

Based on these comparable valuations, a reasonable fair value P/S range for Uber would be 2.5x-3.5x, with a P/E of 40x-50x. At the midpoint valuations, that points to a 12-month target price range of $55-$65 per share.

Weighing the pros and cons, I have a Hold rating on Uber stock currently. While its delivery growth and market leadership are strengths, the ridiculous business still faces headwinds. And with a frothy valuation already, there is likely more upside in waiting for a better entry point.

My recommendation would be to Hold Uber for current investors while waiting to Buy for those looking to initiate a new position until the stock dips closer to the low end of that $55-$65 fair value range.

What the Future Holds for Fintechzoom Uber Stock

Uber is positioning itself for continued growth and expansion in the years ahead. The company projects its Delivery segment, which includes Uber Eats, to maintain a rapid growth trajectory as consumer demand for convenient food delivery remains strong. Uber is investing heavily in this area, enhancing its logistics capabilities and expanding its merchant network globally.

The recently launched Uber Freight division targeting the trucking and logistics industry also holds immense potential. As this segment scales, it could evolve into a significant revenue driver leveraging Uber’s technological capabilities in freight optimization and autonomous trucking down the road.

However, Uber’s core Mobility business centred around ridesharing may face headwinds from macroeconomic pressures. Sustained high inflation levels impacting consumer spending, combined with elevated fuel costs, could constrain growth in ride volumes. Nonetheless, Uber aims to partially offset these impacts through dynamic pricing strategies.

The competitive landscape is also intensifying as rivals like Lyft and traditional taxi services double down on their offerings. Emerging mobility solutions such as self-driving cars and micro-transit options may disrupt the market further. Uber is actively investing in autonomous vehicle technology to stake its claim in this space.

Overall, Uber’s multi-product approach provides diversification benefits, but execution risks remain. The company’s ability to maintain market leadership, control costs effectively, and navigate changing consumer preferences will be crucial to delivering on its lofty growth ambitions.

Conclusion – Fintechzoom Uber Stock

In 2024, Uber stock presents an intriguing investment opportunity amidst a complex landscape of challenges and potential. While the rideshare giant has faced headwinds from rising fuel costs and intensifying competition, its diversification into delivery services and freight transportation opens new avenues for growth.

Uber’s financial performance has been a mixed bag, with strong revenue growth but persistent profitability concerns. However, the company’s market leadership, innovative spirit, and aggressive expansion strategies position it well for long-term success.

For investors with a bullish outlook, Uber’s dominance in the rideshare market, coupled with its growing presence in complementary verticals like Uber Eats and Uber Freight, could translate into substantial returns. The company’s ability to leverage its vast network and data insights provides a competitive edge.

Conversely, bearish investors may cite Uber’s ongoing struggles with profitability, regulatory hurdles, and the looming threat of self-driving technology disrupting the traditional rideshare model. Competition from well-funded rivals and potential market saturation could also hinder Uber’s growth trajectory.

Ultimately, a buy, hold, or sell decision on Uber stock hinges on an investor’s risk tolerance, investment horizon, and confidence in the company’s ability to navigate the evolving mobility landscape. Regardless of the stance, Uber’s journey promises to be a captivating one, shaping the future of transportation and logistics.