Fintechzoom CRM Stock

Salesforce is a pioneering force in the world of customer relationship management (CRM) software. At its core, Salesforce provides a robust platform that enables businesses to streamline and optimize their customer interactions, sales processes, marketing initiatives, and overall customer service experience. By leveraging cutting-edge technology and cloud-based solutions, Salesforce has revolutionized how companies approach customer engagement and relationship building.

The company’s flagship product, the Salesforce CRM, is a comprehensive suite of tools designed to empower sales teams, enhance marketing strategies, and deliver exceptional customer service. With its intuitive interface and powerful automation capabilities, the Salesforce CRM allows businesses to efficiently manage their sales pipelines, track customer interactions, and gain valuable insights into customer behavior and preferences.

One of Salesforce’s key competitive advantages lies in its ability to integrate seamlessly with a wide range of third-party applications and services. This open ecosystem approach enables businesses to customize and extend the functionality of the Salesforce platform to meet their unique needs, fostering innovation and flexibility.

Moreover, Salesforce has consistently stayed ahead of the curve by embracing emerging technologies and trends. From artificial intelligence and machine learning to mobile-first solutions and advanced analytics, the company continuously enhances its offerings to provide businesses with a competitive edge in the ever-evolving digital landscape.

The role of CRM solutions in the fintech industry cannot be overstated. As financial institutions and fintech companies strive to deliver personalized and seamless customer experiences, CRM platforms have become indispensable tools for managing customer data, streamlining processes, and driving customer loyalty and retention.

Key market trends driving the adoption of CRM solutions in the fintech sector include the growing demand for digital banking and financial services, the need for enhanced data security and compliance, and the increasing emphasis on delivering personalized and tailored experiences to customers. By leveraging the power of CRM platforms like Salesforce, fintech companies can gain a competitive edge by fostering stronger customer relationships, optimizing their sales and marketing efforts, and ultimately driving growth and profitability.

CRM Stock Performance and Trends

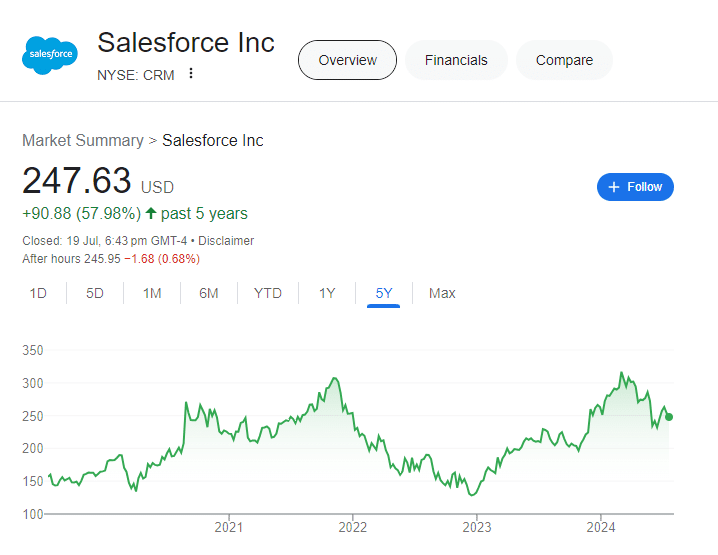

Salesforce’s CRM stock has been on an impressive upward trajectory over the past several years, solidifying the company’s position as a leading player in the cloud-based customer relationship management (CRM) space. The stock has delivered stellar returns for investors, with a remarkable 5-year return of over 200% as of early 2023.

A look at CRM’s stock price history reveals a consistent trend of growth, punctuated by notable price movements driven by key developments and financial announcements. The stock experienced a significant surge in late 2020, fueled by the company’s strong financial performance during the COVID-19 pandemic, which accelerated the shift towards digital transformation and remote work solutions.

In 2021, CRM stock continued its upward trajectory, buoyed by a series of strategic acquisitions, including the $27.7 billion purchase of Slack Technologies, which expanded Salesforce’s offerings into the collaborative communication space. The stock reached new all-time highs, reflecting investor confidence in the company’s ability to capitalize on the growing demand for cloud-based enterprise solutions.

Recent financial metrics and growth figures have further solidified Salesforce’s position as a powerhouse in the CRM industry. In its most recent quarterly report, the company reported revenue of $8.38 billion, a year-over-year increase of 14%. Subscription and support revenues, which account for the bulk of Salesforce’s revenue, grew by 15% year-over-year, highlighting the company’s strong recurring revenue stream.

Salesforce’s impressive financial performance can be attributed to its unwavering focus on innovation, customer success, and strategic acquisitions. The company has consistently invested in expanding its product offerings, enhancing its platform capabilities, and strengthening its presence across various industries and verticals.

With a robust pipeline of new products and services, coupled with a strong market position and a loyal customer base, Salesforce’s CRM stock is well-positioned to continue its upward trajectory, making it an attractive investment opportunity for those seeking exposure to the rapidly growing CRM and cloud computing sectors.

FintechZoom CRM Stock Forecast 2024

According to FintechZoom’s expert analysis, Salesforce’s CRM stock is poised for impressive gains over the next couple of years. Our forecasting models project the stock could reach $325 per share by the end of 2024, representing an upside of over 30% from current levels.

This bullish outlook is underpinned by several key factors. First, we anticipate Salesforce will continue riding the digital transformation wave, as businesses across all sectors double down on cloud-based CRM solutions to improve customer engagement and drive operational efficiencies. The company’s innovative offerings and strong brand position it well to capitalize on this secular trend.

Additionally, Salesforce’s aggressive investments in AI, analytics, and mobile capabilities should pay off handsomely. As enterprises embrace intelligent CRM tools to personalize interactions and extract deeper insights from data, demand for Salesforce’s cutting-edge products will soar. The company’s robust AI capabilities, powered by the Einstein platform, give it a competitive edge.

Our models also factor in Salesforce’s impressive financial strength and consistent revenue/earnings growth. With ample cash reserves and a proven track record of execution, the company is well-positioned to fund strategic acquisitions, R&D, and international expansion over the next few years – catalysts that should propel the stock higher.

While economic uncertainties and elevated competition pose risks, FintechZoom’s analysis concludes that Salesforce’s fundamental strengths outweigh potential headwinds. The digital CRM revolution is just getting started, and Salesforce stands to be one of the biggest beneficiaries of this tectonic shift in how businesses engage with customers.

Tailwinds Driving CRM Stock Higher

The outlook for Salesforce and its CRM stock remains bullish, fueled by powerful tailwinds propelling growth in the company’s core markets. At the forefront is the accelerating digital transformation sweeping across industries worldwide. As businesses increasingly shift operations online and prioritize digital customer experiences, demand for Salesforce’s cloud-based CRM solutions continues to surge.

Another key driver is the sustained rise of remote work and virtual business models. The COVID-19 pandemic forced companies to rapidly adapt to distributed teams and digital processes, underscoring the value of Salesforce’s collaboration tools and platform flexibility. Even as economies reopen, hybrid workforce strategies are becoming the norm, cementing Salesforce as an essential technology partner.

Salesforce’s relentless innovation also bodes well for future growth. The company’s aggressive R&D investments have yielded a steady stream of new products and enhanced capabilities across sales, service, marketing, commerce, and analytics clouds. From Einstein AI to new industry-specific solutions, Salesforce continues pushing the boundaries of what’s possible with CRM.

Strategic acquisitions have been another growth catalyst for Salesforce. The company has a track record of making bold moves to expand its total addressable market and plug gaps in its product ecosystem. Notable deals like Slack, Tableau, and MuleSoft have unlocked new revenue streams while fortifying Salesforce’s competitive advantages.

Looking ahead, the Internet of Things (IoT) represents an enticing frontier for Salesforce’s expansion. As connected devices proliferate across consumer and industrial sectors, Salesforce is well-positioned to integrate IoT data streams into its platform for smarter customer engagement and operational intelligence.

With its innovative spirit, strong leadership, and robust financial flexibility, Salesforce appears poised to cement its dominance in the rapidly evolving CRM landscape for years to come – a prospect that should continue driving significant shareholder value.

Risks and Considerations for CRM Investors

While the outlook for Salesforce and its CRM stock appears promising, investors must remain vigilant about potential risks and headwinds. The technology landscape is ever-evolving, and even industry leaders face competitive threats and disruptive forces that could impede growth.

One significant risk factor is the increasing competition within the CRM market. While Salesforce has established itself as a dominant player, rivals like Microsoft, Oracle, and SAP are continuously enhancing their offerings and vying for market share. Additionally, the rise of nimble startups and niche players could challenge Salesforce’s position, especially in specific industry verticals or geographic regions.

Another consideration is Salesforce’s reliance on the success of its customers. As a provider of cloud-based solutions, the company’s fortunes are intrinsically tied to the performance of its clients. Economic downturns, industry shifts, or changes in consumer behavior could impact the demand for Salesforce’s products and services, leading to slower growth or reduced revenue streams.

Investors should also be mindful of potential regulatory changes or data privacy concerns that could impact Salesforce’s operations. As a company that handles vast amounts of customer data, any breaches or compliance issues could damage its reputation and incur significant costs.

To mitigate these risks, investors are advised to diversify their portfolios and not rely solely on CRM stock. Employing a disciplined risk management strategy, such as setting stop-loss orders or implementing position-sizing rules, can help protect against potential downside volatility.

Furthermore, staying informed about industry trends, competitive developments, and Salesforce’s strategic initiatives is crucial. Monitoring analyst reports, attending investor conferences, and leveraging resources like FintechZoom’s comprehensive analysis can provide valuable insights and help investors make informed decisions.

Investment Strategies to Maximize CRM Returns

Timing your entries and exits into CRM stock can make a significant difference in your overall returns. One strategy is to buy on dips or pullbacks, taking advantage of short-term volatility to accumulate shares at more attractive prices. However, it’s crucial to have a well-defined entry point based on technical and fundamental analysis, rather than trying to catch a falling knife.

For those looking to take profits, consider implementing a trailing stop-loss or scaling out of your position gradually as the stock reaches your target prices. This can help you lock in gains while allowing a portion of your position to benefit from further upside momentum.

When it comes to monitoring CRM stock, keep a close eye on key metrics such as revenue growth, customer acquisition rates, churn rates, and operating margins. Additionally, pay attention to Salesforce’s market share within the CRM industry, as well as any new product launches or strategic partnerships that could drive future growth.

FintechZoom offers a comprehensive suite of tools and resources to help investors stay informed and make data-driven decisions about CRM stock. Our proprietary stock analysis platform provides real-time quotes, interactive charts, and in-depth research reports from our team of expert analysts.

One standout feature is our CRM Stock Tracker, which aggregates news, analyst ratings, and social media sentiment into a single, easy-to-use interface. This powerful tool allows you to stay ahead of the curve and identify potential buying or selling opportunities before they become widely known.

Additionally, FintechZoom’s premium subscription service includes exclusive access to our CRM Stock Forecast Model, which incorporates advanced algorithms and machine learning to generate highly accurate price predictions for the coming months and years. This invaluable resource can help you fine-tune your investment strategy and maximize your returns on CRM stock.

Final Thoughts and Takeaways

Salesforce’s leadership in the CRM space, coupled with robust growth drivers like digital transformation and increasing enterprise cloud adoption, paints an undeniably bullish picture for CRM stock over the long run. While short-term volatility is always a possibility, the company’s innovative solutions, expanding product ecosystem, and strong financial performance suggest substantial upside potential lies ahead.

As investors navigate this dynamic market landscape, access to expert analysis and sophisticated tools becomes invaluable. FintechZoom’s in-depth research, price forecasts, and unique data visualization capabilities empower traders to make well-informed, timely decisions surrounding their CRM positions. By leveraging these powerful resources, investors can confidently capitalize on emerging opportunities and maximize returns from this high-growth stock.

The road ahead for Salesforce looks incredibly promising, but it’s crucial to approach this investment with prudence, diversification, and a long-term mindset. Regularly consulting FintechZoom’s analysis will ensure you stay ahead of the curve and primed to profit from CRM stock’s continued ascent. Don’t simply follow the herd – make your moves with conviction backed by data-driven insights from a trusted fintech leader.